The Facts

The planning system is such a hotly debated subject across the UK. The different objectives and resulting tension between developers and local authorities does little to help these two parties to reach a consensus – slowing down the delivery of new homes.

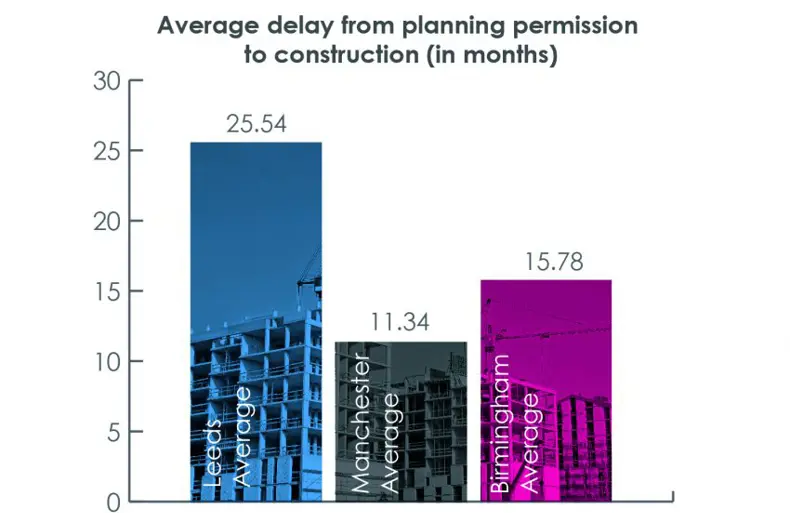

The recent National Audit Office (NAO) review of government planning policy predicts that 50% of local authorities will fail to provide the required amount of housing set by the Ministry of Housing, and the Department for Communities and Local Government (DCLG). However, vast gaps at local level across council funding, skills and collaboration between the private and public sector are not helping local authorities to meet their targets. Let’s look to the regions of Leeds, Manchester and Birmingham to examine average timelines currently associated with residential permissions.

Analysis of the planning permission to construction timelines

Using data from the City Council’s Leeds, Manchester and Birmingham, I have analysed the timelines between key milestones in the residential development process. The graphs below show the outcomes:

Birmingham

Birmingham has seen 23 construction starts in the last 12 months, primarily consisting of residential developments. The city boasts the shortest build programmes; from planning permission to completion, on average it takes 34.8 months.

Manchester

Manchester has the highest number of onsite developments across northern regions, with 48 residential schemes currently underway. However, over the last couple of years, we have seen a peak in the volume of planning applications to construction. In the last 10 years, we have seen 13,439 units complete and a further 14,480 are anticipated to complete in the next two years. It will come as no surprise that Manchester also has the shortest delay from planning permission to construction start; developers operating in the area are eager to get onsite. The housing market is performing well in Manchester and developers are confident and not afraid to bring developments forward. In light of this, developers must be careful not flood the market, especially the city centre where product and pricing is particularly sensitive. I estimate this could be seen as one of the few or only negative sides to the fast-paced planning system – the potential for oversupply. It is estimated that Manchester needs 3,000 new homes a year, however, the city has and continues to exceed this.

Leeds

Leeds had the most active construction-year to date. There are 21 new construction starts so far this year, although only three of those are residential. However, we are seeing a significant number of student accommodation units in this pipeline there are 2,768 purpose-built beds under construction to cater for the growing number of students in Leeds.

In comparison to Manchester, whereby investors can evidence a market performing well, developers in Leeds are slightly more cautious, especially those who bought land at inflated prices and are patiently waiting on optimising the value of the site. There is presently little that a planning department can do to ensure that once consent is granted, a timely start on development is made. You will see the delay in planning applications is most significant in the city centre. This is an area specifically looking to be addressed by Housing Infrastructure Funding (HIF). Leeds has submitted a bid for £60 million to specifically assist in bringing city centre developments forward. If the bid is successful the councils aim is to bring forward 8,500 houses in the city centre by 2033. The stage is set for Leeds and the best is yet to come.