Blog | Business Rates | Landlord

The end of the 2017 Rating Revaluation – A Landlord's Opportunity

The period leading up to 31 March is usually busy in any given year. For 2023, however, the date that marks the end of the financial year also signifies the end of the 2017 rating revaluation. This means that all appeals against a property’s rateable value must be made by this date if a landlord is to claim backdated savings and, potentially, reduce their rates for the next period.

For those very rare (and fortunate) landlords that have had fully let portfolios for the whole of the past five-and-a-half-year period, this is less important. For the remaining vast majority, this deadline offers a potential opportunity. There are a number of scenarios that, if they’ve occurred over the past five and a half years, could mean a landlord should make a backdated rating appeal that may well turn into a backdated saving. While some of these scenarios, including asbestos and squatters, are not time sensitive, others are and the end of the revaluation therefore provides an ideal backdrop against which to consider whether you could secure backdated savings.

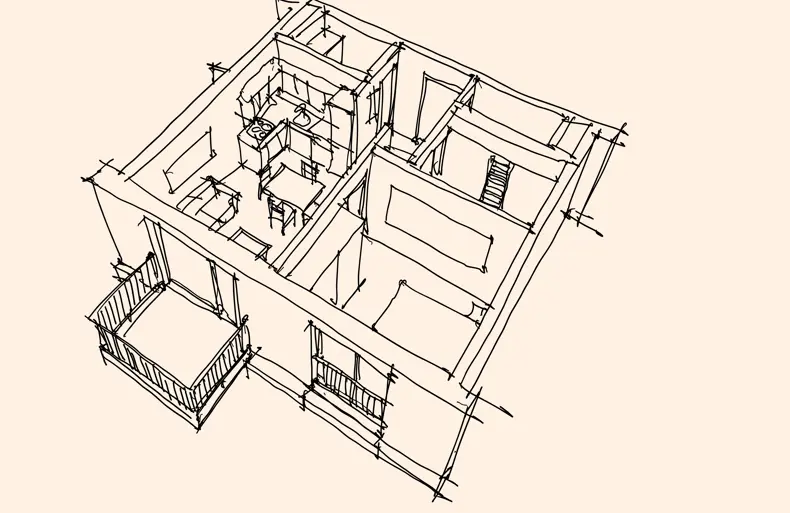

1. Previous schemes of refurbishment or redevelopment

If any scheme of refurbishment or redevelopment works have occurred across your portfolio, there is an opportunity to lodge an appeal seeking a backdated deletion. In short, a property needs to be capable of being beneficially occupied for a given use (e.g. an office) to be liable for rates. So, if you stripped out a floor of an office building to shell and core, you would be unlikely to be able to offer it as an occupiable office – as it is in fact a building site at the time. Therefore a backdated deletion could provide a large refund opportunity, as the rates that were paid during that period of redevelopment could be claimed back. For any historic works, you could seek a backdated deletion from the date of strip-out until the date that the works completed – and potentially even later by delaying the re-entry of the new assessment into the rating list. The important point here is that this scheme of works could have happened at any point from 1 April 2017 onwards.

2. Works that involved the removal of asbestos

This is not technically a time limited appeal; however, it does largely go hand-in-hand with the redevelopment guidance given above. Historically, we have found that a lot of office-to-residential permitted development (PD) schemes experienced large amounts of asbestos to strip out as part of their scheme of redevelopment. This is an example of using rating case law to approach the Local Authority directly (rather than the Valuation Office Agency) to seek an exemption for the period of removal – provided that there is enough evidence of asbestos to support any claim.

3. Any period of squatting

Live-in security and property guardians can protect landlords from the headache that is having a squatted building. However, if a landlord ends up in the unfortunate position of dealing with squatters, a potential silver-lining here is that there may be grounds to recover the rates liability relating to their period of occupation. As with the previous point on asbestos, this too is an issue that would involve a reliance on case law and conversing directly with the Local Authority.

4. Vacant floors - currently vacant and long-term vacancy

Another opportunity for landlords to potentially secure a rates reduction is where they have paid or are currently paying rates on vacant space whilst seeking a new occupier. Current vacant space could benefit from a programme of rates mitigation. This is when the floor is physically occupied for a minimum of 42 days before being vacated and therefore triggering either three or six-month periods of empty rates relief (depending on the type of building). This can then be repeated ad infinitum. A review should also be undertaken as to whether there is any potential for a reduction in the rateable value of a building. This could mean challenging the areas, the pricing of the floors or any other aspects of the building to reduce the 2017 Rateable Value. A saving that is achieved through this mechanism will benefit the client with savings potentially backdated to April 2017, and it could also have a positive knock-on effect to the rateable value in the 2023 list.

Related Insights

Business Rates in the Budget

The Chancellor announced that:- Small Business Rates multiplier is fixed again (relevant to properties with an RV below 51,00...

We need a Council Tax revaluation – and we need it now

It's clear the system isn’t fit for purpose and, unless something is done about it, our councils will continue to struggle – ...

New Rating Bill – changing business rates

Parliament is soon going to enact new primary legislation on business rates, which will have an impact on your pocket as well...

Investors have just weeks left to change a decade of business rates

When it comes to business rates, eyes tend to glaze over. Many property investors take the view that nothing is certain in li...