Blog | Commercial Auction | Auction

Why £1m+ lots are increasingly sold at auction

The commercial real estate (CRE) market is undergoing significant transformation, with online commercial property auctions emerging as a powerful and increasingly preferred sales platform. This method of sale is not only redefining speed and efficiency but is also enabling sellers and buyers to transact larger and higher-value assets with transparency and confidence.

The Strength of Auctions: Speed, Efficiency, and Control

One of the key strengths of the auction process lies in its speed and efficiency. Unlike private treaty sales, which are typically protracted and vulnerable to delays, auctions allow sellers to dictate terms and establish a clear timeline for the transaction. For motivated sellers, this means they can achieve a successful outcome swiftly and avoid the uncertainty that often accompanies longer sales cycles.

The auction process also benefits buyers by offering a streamlined, transparent platform. With legal packs disclosed upfront, buyers have access to all relevant information, allowing them to make informed decisions. This level of clarity eliminates surprises that often arise in private treaty sales, where unforeseen issues can lead to delays or price renegotiations.

Why Are We Seeing Larger Lot Sizes?

In recent years, there has been a noticeable trend toward larger commercial real estate lots appearing at auction. Several factors have contributed to this shift:

- A Lack of Comparable Evidence:

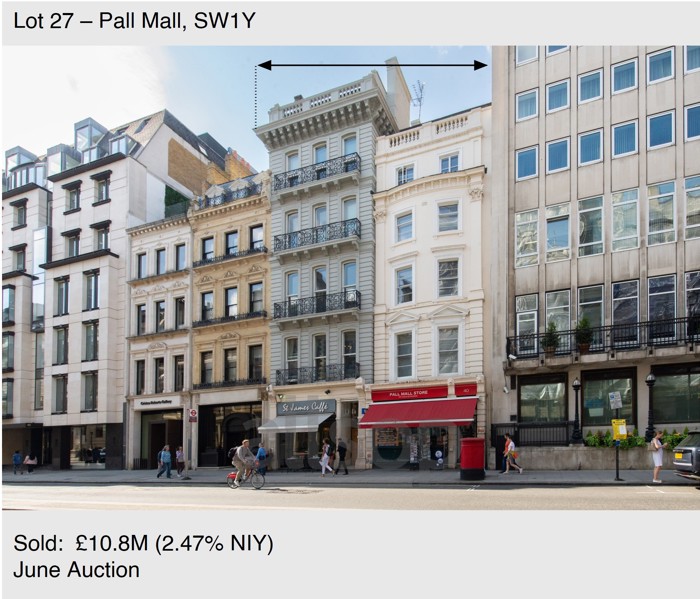

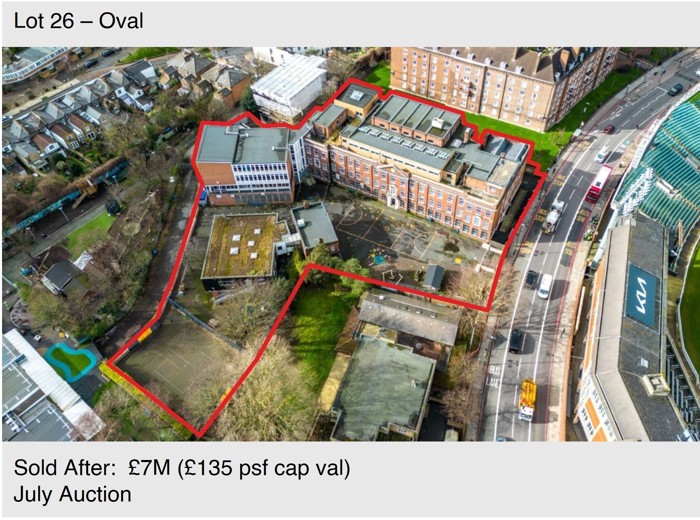

In a market where valuations can vary significantly between agents due to a lack of comparable evidence, the auction process allows a true accurate market price to be determined at a single moment through competitive bidding. This dynamic creates an efficient environment that benefits both sellers and buyers.

- Protracted Private Treaty Negotiations:

Historically, private treaty sales would take 2-3 months to complete after agreeing heads of terms. Today, that timeframe has increased to 4-6 months for smaller lot sizes and up to 6-9 months for larger transactions. By contrast, auctions enable sellers to bring transactions to a successful conclusion quickly, providing certainty and liquidity.

- Access to Motivated Sellers & Well Capitalised Buyers:

The number of participants at our Commercial Auctions is growing and there is no shortage of buyers with significant cash reserves. We consistently find a high proportion of buyers at our commercial sales are new, no doubt attracted by the easy accessibility of information, and are ready and willing to deploy funds for correctly priced assets.

At the same time, we are acting for an increasing number of new motivated sellers who look to the auction method of sale for easy access to cash buyers, so that they can realise sales proceeds within a defined period of time and execute their strategic plans. It makes the auction process a natural fit.

- Auction Transparency and Certainty:

Auctions offer unparalleled transparency, with unconditional, binding contracts providing clarity for all parties. This level of certainty is particularly valuable in the CRE market, where larger transactions require confidence in both the process and the outcome.

- Financing Flexibility:

While the auction process traditionally favours cash buyers or those using short-term bridging finance, this does not preclude investors from securing long-term debt after completion. Increasingly, private investors recognise that financing post-sale can be a viable strategy, further broadening the appeal of auctions.

Commercial Auctions: A Mature Market

Ultimately there is a growing realisation among savvy investors that commercial real estate auctions are not a distressed sales environment. Unlike the residential auction market, which accounts for over 90% of all auction sales and often has a large proportion of discounted sales, the commercial market operates with a far more mature and knowledgeable investor base. Where Buyers and sellers alike appreciate that auctions deliver fair market value through competitive tension. Larger CRE lots are no longer being viewed as high-risk opportunities, but as strategic investments facilitated by a transparent, efficient process.

The Evidence is in the Numbers:

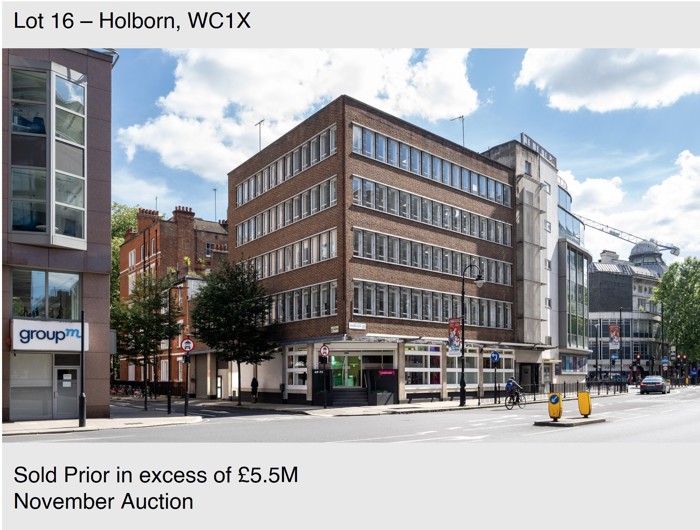

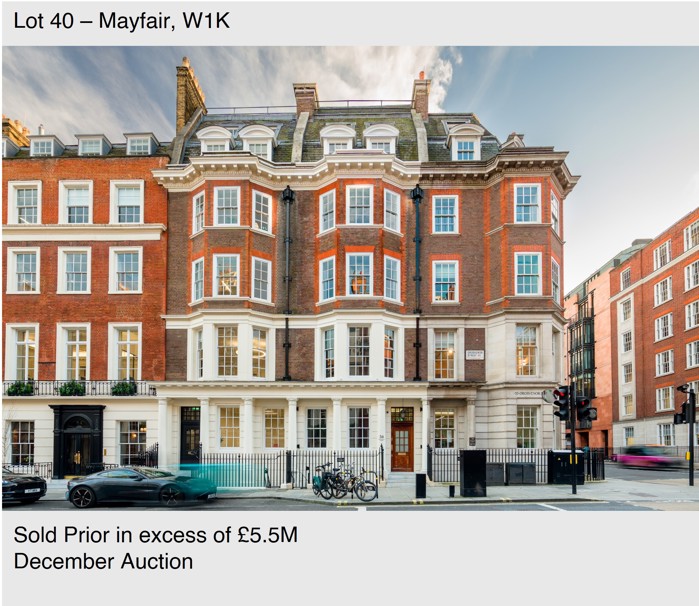

The growing popularity of commercial real estate auctions is reflected in the results. In 2024 Allsop Commercial have witnessed:

- 585 lots sold (compared to 679 in 2023),

- £462m total sales, representing a robust 89% success rate (£432m and 90% in 2023),

- 133 lots sold for over £1m, maintaining last year’s levels.

Notably, the average lot size has increased from £680,000 in 2023 to £790,000, underscoring the increasing confidence and appetite for larger assets at auction.

Conclusion

As the commercial real estate market evolves, online property auctions are cementing themselves as a powerful tool for unlocking value and delivering certainty in uncertain times. The increasing lot sizes and robust demand from buyers are testament to the strength of the auction process as a platform for fair, efficient, and transparent transactions.

For sellers seeking speed and control and for buyers ready to deploy capital for correctly priced opportunities, auctions are proving to be a highly effective route to success. With rising average lot sizes and a market characterised by transparency and competitive tension, the commercial property auction market is set to play an increasingly important role in the future of real estate transactions.

For more insights into the growing role of online auctions in the commercial property market, or to explore opportunities, please get in touch with a member of our market leading team today.

Related Insights

Allsop’s back-to-back commercial and residential auctions raise over £58 million

Allsop, the leading property consultancy and the UK’s largest property auction house, raised £58.1million through back-to-bac...

Allsop releases catalogue featuring £7.8m lot for March commercial auction

Allsop, UK’s largest property auction house, has released the catalogue for its March commercial auction, featuring 106 lots ...

Allsop releases 236-lot catalogue for March residential auction

Allsop, a leading property consultancy and the UK’s largest property auction house, has released the catalogue for its March ...

Allsop raises £55 million in February residential auction

Allsop, the leading property consultancy and the UK’s largest property auction house, raised £55 million at its latest reside...